Below is a list of the main tax events coming up which you should know about now. It is important to be aware that filing your tax return late or failing to pay the tax you owe on time, could mean you face extra penalty fees and interest charges. It is therefore recommended that you authorise a tax specialist such as Beavis Morgan to handle your tax affairs and deal with HM Revenue & Customs on your behalf. This will ensure that all deadlines are met and that you are not paying more tax than you need to.

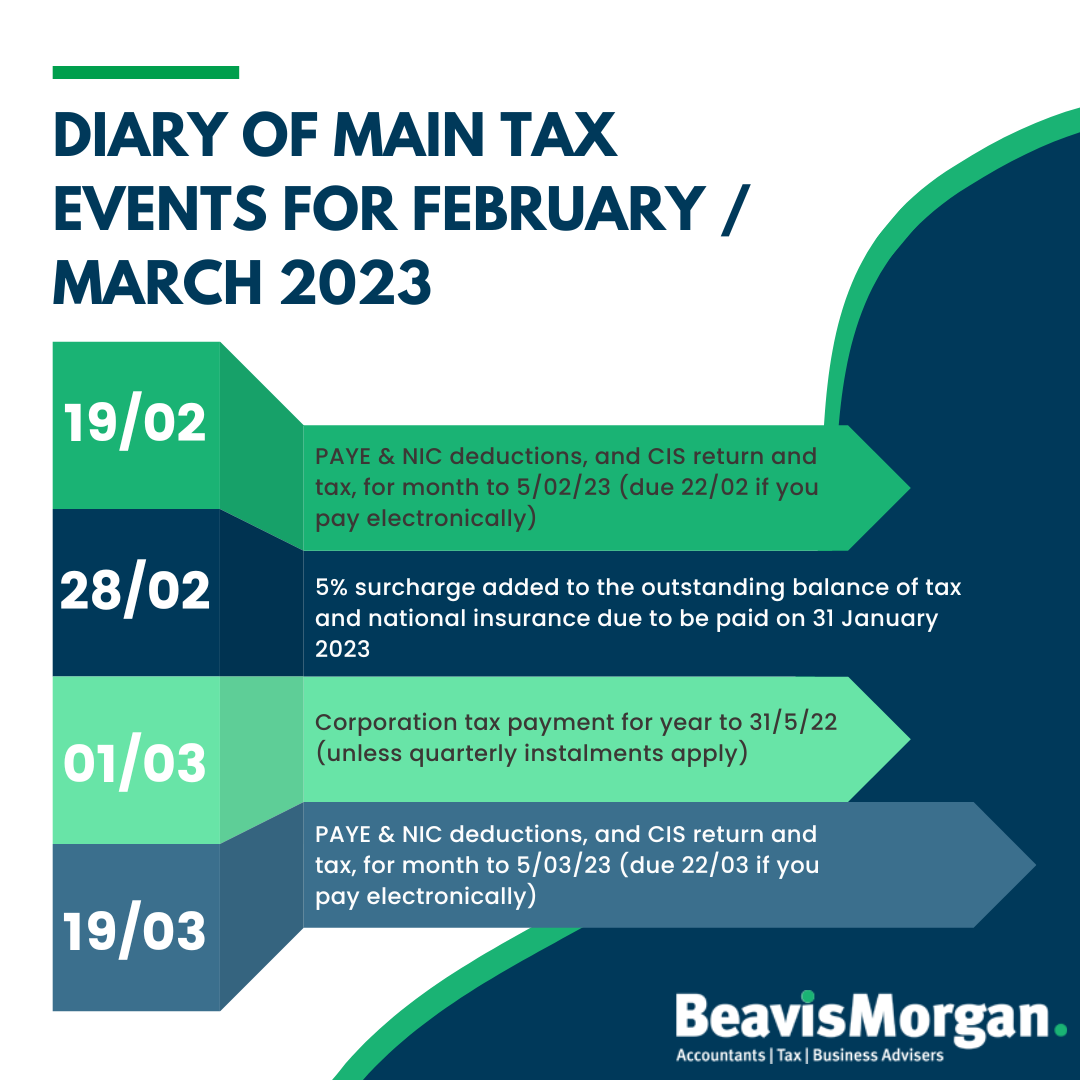

| Date | What’s Due |

| 19/02 | PAYE & NIC deductions, and CIS return and tax, for month to 5/02/23 (due 22/02 if you pay electronically) |

| 28/02 | 5% surcharge added to the outstanding balance of tax and national insurance due to be paid on 31 January 2023 |

| 01/03 | Corporation tax payment for year to 31/5/22 (unless quarterly instalments apply) |

| 19/03 | PAYE & NIC deductions, and CIS return and tax, for month to 5/03/23 (due 22/03 if you pay electronically) |

At Beavis Morgan, our diverse team of tax professionals are committed to ensuring that your tax reporting obligations are fully satisfied and that every opportunity to lawfully exploit tax savings is made known to you, restructuring your affairs in a tax-effective and efficient way.

For more information and to discuss your tax affairs in further detail, contact your usual Beavis Morgan Partner or email info@beavismorgan.com.